Despite what the well-known phrase “What you don’t know can’t hurt you” might have you believe, in fact, the opposite is often all too true. For small and medium-sized businesses especially, the unknown presents pretty major risks.

Profit margins run slim and one bad quarter could send SMBs on the wrong path and away from financial solvency. In this way, unseen costs are incredibly pernicious and represent a clear and present danger to the well-being of SMBs everywhere. Whether they’re operational inefficiencies, labor overruns or unprofitable promotions, expenses that fly under the radar cost businesses money. To maintain healthy bottom lines, organizations should consider their options for identifying and addressing unknown costs.

Look Beyond Common Culprits

Hidden costs are so prevalent that it can be extremely difficult to weed them all out. Many businesses focus on common unseen expenses but fail to identify those lurking further out of view. For instance, Small Business Trends pinpointed five hidden costs that go hand-in-hand with running a business:

- Employee turnover

- Shrinkage

- Legal fees

- Payroll taxes

- Maintenance

Those are all important expenses to account for and track, and thankfully they are relatively easy to identify and build into budget plans.

Companies that can’t afford a single minute of downtime or performance drops in their mission-critical systems should incorporate database load balancing software to assuage their fears and ensure their most important systems are always online and always available.

There are far more costly items that are likely to evade detection without the help of profitability and cost-efficiency analysis solutions. To maximize return on investment for every aspect of your business, a full-scale assessment is essential.

Going Beneath the Surface

Let’s say you oversee a local branch of a credit union network. You may measure success by the sheer number of branch members or program enrollees. Those figures don’t tell the whole story from a profitability perspective, however. How much do you spend to acquire each new customer or entice members to sign up for new programs? The cost-benefit ratio could be offsetting – or worse. You may actually lose money on those initiatives when it’s all said and done.

It’s not unusual, for instance, for popular rewards programs to actually be too generous and made available to an overly wide audience. As such, bank or credit union branches may be leaving too much money on the table in the pursuit of higher enrollment figures.

Loans are other services that can be more trouble than they’re worth once you’ve sat down and actually assessed the cost-benefit analysis. Certain types of loans may be unprofitable in the long run due to discounts, low returns or the potential risk taken on by the financial institution.

These are just a few examples, but they highlight the importance of a comprehensive profitability analysis to identify unseen costs that are hurting your bottom line.

Another major expense is unused capacity, including employee responsibility overlap, back-office workflows that could easily be handled by offshore teams and excessive employee downtime. Getting the most out of the resources you already have is critical, but many organizations overlook labor efficiency and productivity when searching for opportunities to optimize operations.

Capacity levels and associated costs can drastically fluctuate throughout the year, month, week or even day. Depending on the location, branches could see more foot traffic at the beginning of the day or just before closing, while others will be busier when other businesses take their midday lunch breaks. Accounting for those surges should be an integral part of your cost-benefit analysis strategy, so you can be sure that there are enough employees on hand to manage an influx in business without wasting a lot of money on staffing during non-peak hours.

Understanding the Profitability and Cost-Efficiency Process

There’s an incredible amount of ground to cover with any profitability analysis, but to get started, you should aim to answer a few key questions:

- Where is your business making money, and which processes, products, and services are actually costing you money?

- How can you provide high-quality services to your clientele while keeping costs in check and maintaining optimal profitability?

- Are you managing your staff in a way that maximizes productivity and minimizes unused capacity?

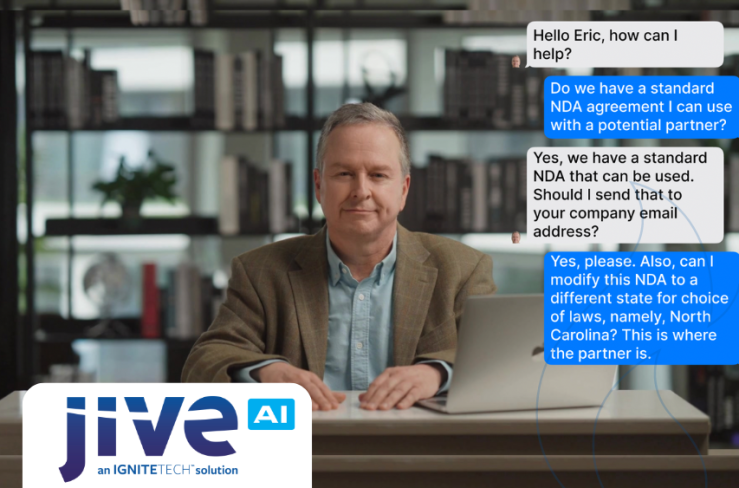

It’s unwise for financial services providers and other organizations to go it alone when calculating a comprehensive profitability analysis. Working with experts like Ignite Technologies, and using the Acorn Performance Analyzer 5G, businesses of all stripes can be sure that they get an accurate, granular assessment of their operations and bring all unseen costs to light.